Facebook and OTT advertising may offer similar programmatic opportunities, but the two formats generally win over a different set of advertisers.

Over the last few weeks, we’ve dug into Facebook advertising data and released a Facebook advertising trend report.

We’ve gone deep into:

The main insight we’ve gathered is that Facebook is excellent at understanding its advertising audiences and their needs. And Facebook pursues small, niche advertisers in earnest.

As we look into the complex ecosystem of OTT advertising, we find that the format is currently best suited for brands that have the budget for experimentation and those seeking the scale of linear TV.

Unlike other formats, the advertiser overlap between Facebook and OTT is decreasing. Though we can’t identify the cause exactly, we can look at the latest OTT developments to build context around the data.

OTT: The Merging of Linear TV and Digital

Though cable cutting continues to grow, TV isn’t being eliminated: it’s expanding and transforming.

“We can all agree that TV’s not going away, it just had a lot of babies,” said TD Dixon, chief growth officer for Post Consumer Brands to AdAge. “So, as marketers, we have to determine which are the right babies for us to focus on.” Within the next decade, most TV will move to the digital environment—creating a fusion of new advantages and challenges for advertisers.

For most advertisers engaging in the fragmented OTT landscape, the format is still largely an experiment. Brands that don’t have the budget to experiment or to hire talent with the skills to test, iterate and innovate aren’t buying the format yet. And from our data, we’ve found that most of those who are buying tend to make relatively small buys.

But for national brands looking for scale—it’s inevitable that they’ll need to master OTT advertising.

Why is it inevitable? The last programming to attract large swaths of live audiences is shifting online.

The most popular programming is going digital

In March the NFL gave Thursday football broadcasting rights to Amazon, beginning in 2023.

This contract marks a significant milestone in the evolution of linear and streaming for multiple reasons. It’s the first time exclusive NFL rights have been given to a digital company. And the NFL is the most popular programming on TV—meaning this contract is the first step in potentially signing over $105 billion worth of media rights to online companies.

“I think it is a sign of the times, and shows the growing scale that OTT platforms have to deliver audiences; we knew this day would come, so it is not surprising to see non-linear platforms becoming key partners with the biggest leagues,” says Michael Law, president, Dentsu’s Amplifi to AdAge. “I suspect we will see more of this with the other league negotiations.”

With the most popular programming exclusively shifting to OTT, brands will have no choice but to follow. Last year, advertising spending on OTT grew just over 40% YoY.

Currently, most ad buying across OTT resembles TV more than digital—most is done via upfronts or across private marketplaces. Only a relatively small amount of OTT ads are purchased programmatically.

But the reasons advertisers choose OTT reflect digital purposes more than TV. Advertisers say they’re investing in OTT because of targeting and efficiency, incremental reach, optimizing creative capabilities and CPM rates.

OTT offers an incredible opportunity to TV and digital buyers—but the landscape is still complicated and measurement is not as dialed in, especially when compared to social. And we can see it in the ad spending.

MediaRadar Insights

This blend of linear scale and digital targeting determines the profile of OTT advertisers and their strategies.

Early adopters of OTT tend to be those who have the budget to partner with ad tech companies and build talented teams (e.g. national brands). But their spend on OTT is still significantly lower than their spend on Facebook.

Though national brands advertise on Facebook, they’re not the target customer Facebook develops tools for and markets to. Facebook sells to a massive amount of highly niche brands who don’t have many other options to easily target their unique audiences.

Numerous small buys and buying from national brands add up to significant revenue for the platform.

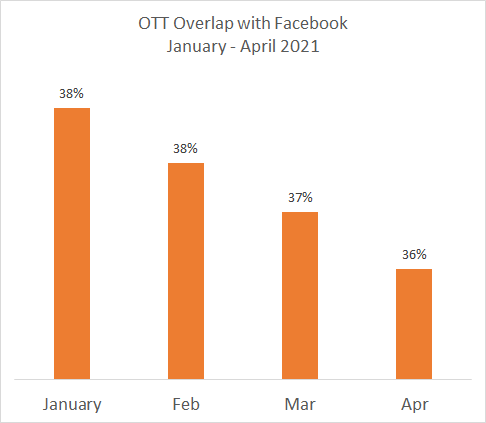

When digging into the commonalities between Facebook and OTT, we found that the overlap between Facebook and OTT is decreasing month-over-month from January – April 2021.

In January, there was a 38% overlap between OTT and Facebook advertisers. By April, that number had dropped to 36%.

Though it seems like a slight difference, it’s relevant because the overlap between Facebook and other formats (e.g. podcasting, TV and other social platforms) is growing.

Top brands who spent on both formats in April include:

- Capital One Shopping

- HBO Max

- The Home Depot

- GrubHub

- Amazon Prime Video

- Discovery+.

Even though these brands spent on both formats, they invested significantly more on Facebook. They spent $70.1mm on the social platform, but only $677k on OTT (less than 1% of Facebook).

The top 5 brands on OTT in the month of April are:

- Microsoft Surface

- Audi of America

- Geico Insurance

- Walmart

- Peloton.

Their spend on OTT added up to $8.1mm, but on Facebook to $4.6mm. They spend on both, but significantly more on OTT. These brands are the outliers who invest more on OTT than Facebook.

Overall, Facebook revenue significantly surpasses that of OTT. In April Facebook brought in $1.3bn in ad revenue compared to $74.2mm spent across OTT. As the format evolves, we’ll continue to identify top opportunities and major shifts in spending.